On‑chain selection: exit‑driven sizing and survivability filters

How we translate early signals into risk‑budgeted exposure without overfitting narratives.

CHAO Fund is focused on Web3 infrastructure and the tokenization of real‑world assets, powered by a data‑driven investment system built for transparency and resilience.

CHAO Fund’s team is not built around a single, traditional model like that of a conventional finance or tech company; instead, it is designed around the real needs of Web3 investing.

Early‑stage investments with a stage‑gate diligence system and thesis alignment.

Early on‑chain selection: a funnel that filters noise and captures asymmetric upside.

Trend trading using multi-layer filters, risk budgets, and de-risking triggers for more disciplined execution.

Long‑term thesis on exchanges, settlement layers, stablecoins, and RWAs.

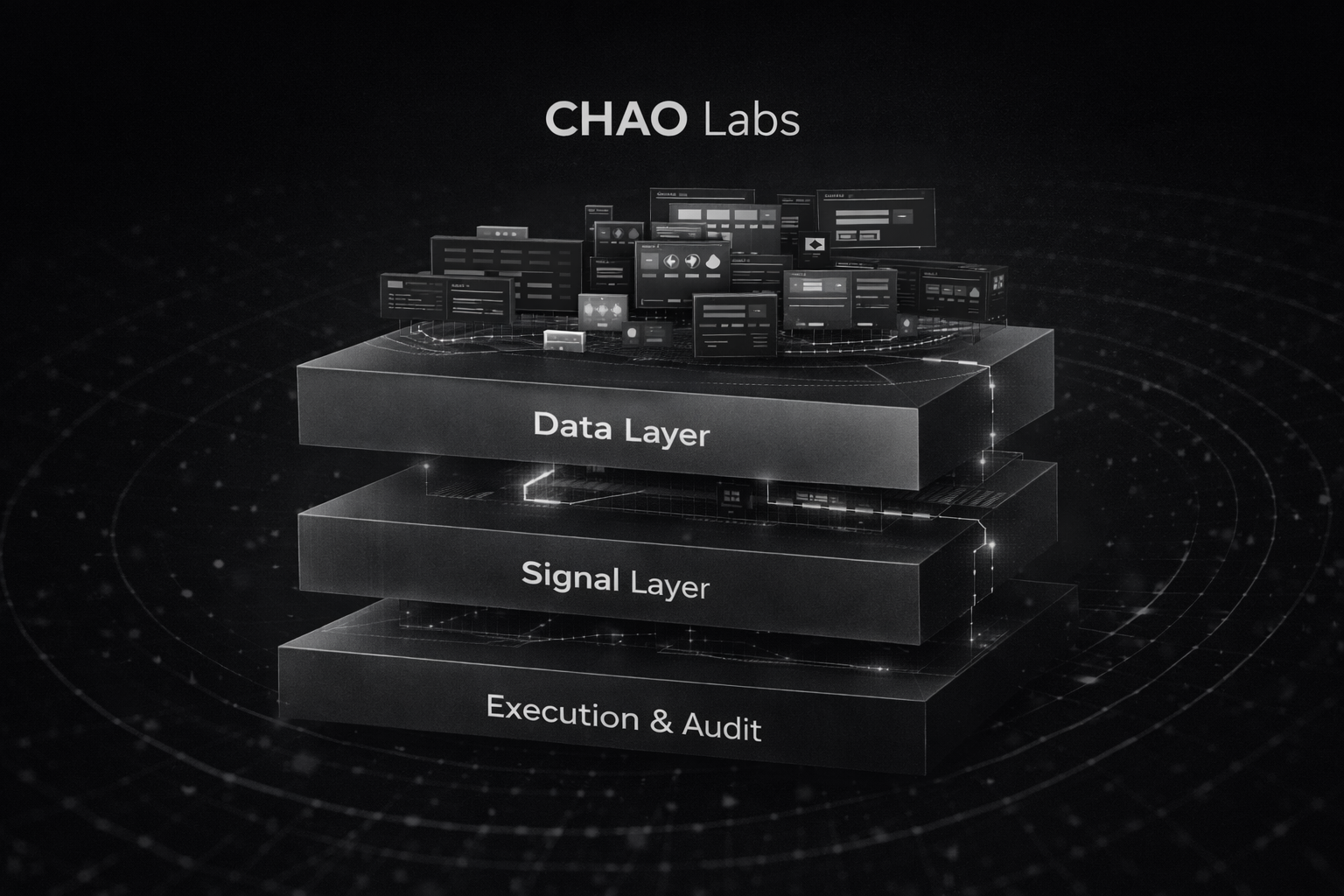

The internal engine that powers research, on‑chain analytics, execution tooling, and continuous calibration.

CHAO Labs transforms raw on‑chain data into actionable signals, then routes decisions through risk budgets and post‑mortem feedback loops—so the organization compounds learning over time.

Indexing, labeling, and high‑frequency capture across chains & venues.

Funnel scoring, anomaly detection, and risk‑aware prioritization.

Playbooks, guardrails, and traceable, reviewable decision artifacts.

We will gradually share more of our asset allocation and research case studies.

Exchanges, settlement layers, cross‑chain infra, and security tooling.

Core primitives: lending, DEXs, derivatives, and yield infrastructure.

Tokenization rails connecting real‑world assets with programmable finance.

Settlement currency for the on‑chain economy and global value transfer.

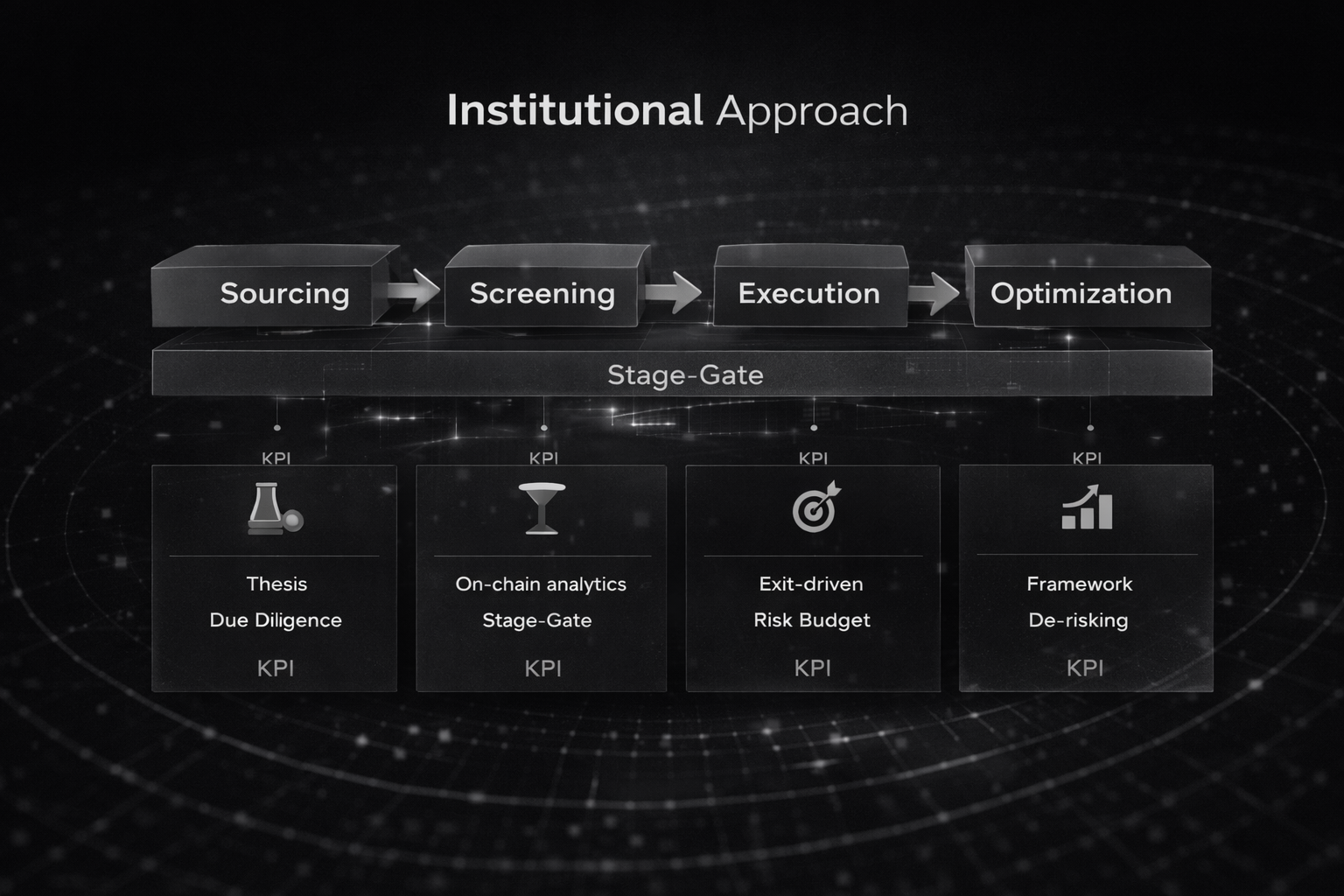

A disciplined pipeline that keeps velocity while preventing narrative‑driven drift.

Decisions pass through consistent gates: thesis fit, on‑chain verification, exit feasibility, and risk budget sizing—then feedback returns to improve the next cycle.

Checklists, scoring, and audit trails reduce irreversible errors.

Clear thresholds preserve reaction time without sacrificing rigor.

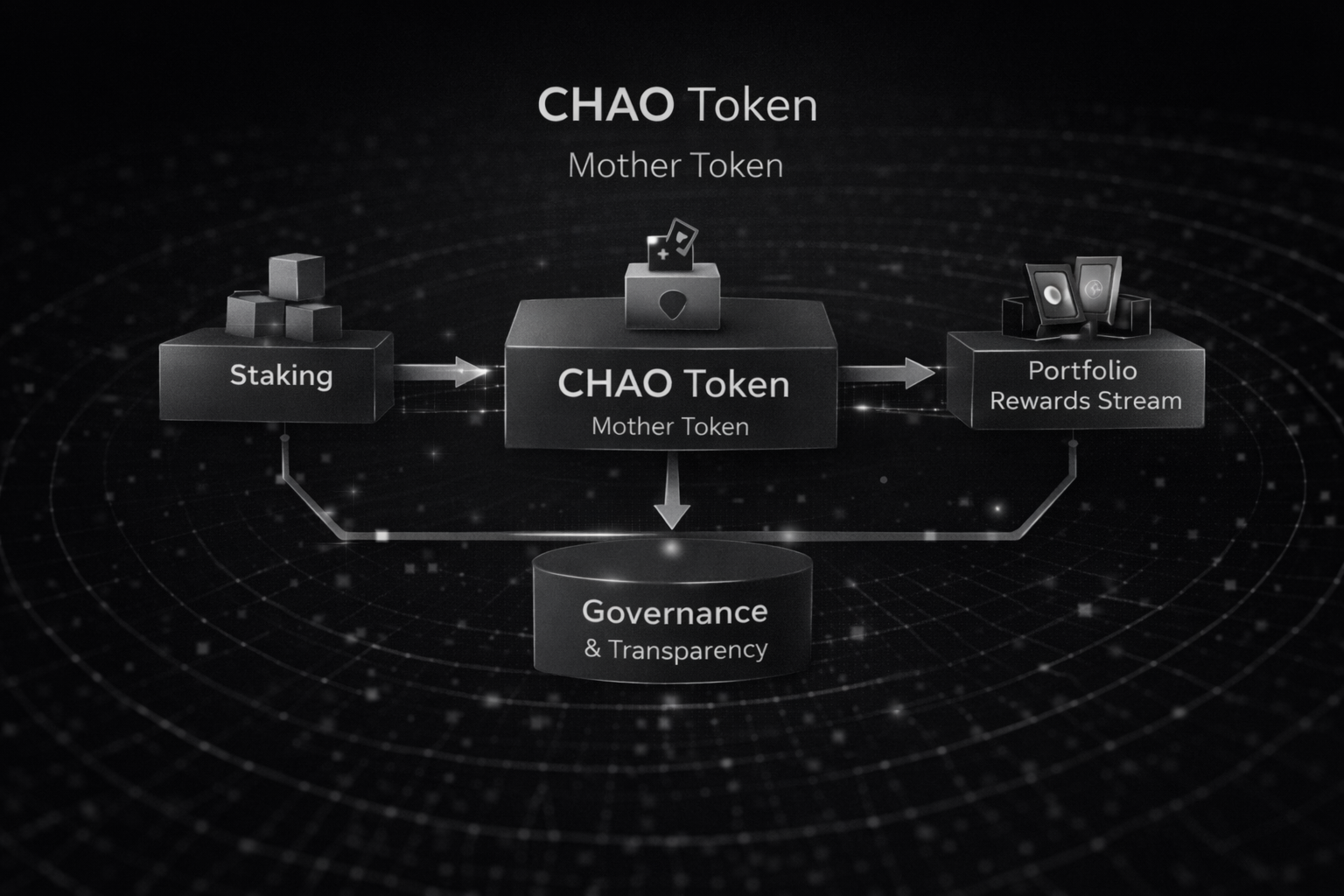

A “mother token” design: governance + value accrual + portfolio rewards stream.

CHAO aligns stakeholders through transparent governance and portfolio‑linked rewards, designed to scale with CHAO Fund’s expansion into infrastructure, stablecoins, and RWAs.

Proposals, parameters, portfolio inclusion, and risk controls.

Buybacks / burns, fee capture, and protocol‑level accrual mechanisms.

Portfolio airdrops and yield distribution for long‑term stakers.

We will gradually make more learning materials and industry data publicly available.

How we translate early signals into risk‑budgeted exposure without overfitting narratives.

Distribution, compliance, reserve structures, and the edge cases that matter.

A framework for evaluating execution environments, data availability, and settlement.

Keep LP‑facing artifacts in one place: whitepaper, methodology notes, governance charter, risk disclosure, and periodic updates.

Portfolio notes, market structure, risk posture, and pipeline snapshot.

Methodology for metrics, dashboards, and on‑chain signal definitions.

A long‑term builder mindset: infrastructure first, discipline always, and transparency by design.

We prioritize systems that survive volatility: strict risk budgets, staged validation, and repeatable decision processes that compound learning.

Add a contact channel and compliance disclaimer here. The layout is ready for your content and branding.